- Operating profit up 3% year-on-year

- Lending up 3% year-on-year

- Income maintained

- Costs 2% lower year-on-year

| FINANCIAL RESULT (GBP millions) | Q3 2019 |

Q3 2018 |

Index 19/18 |

|---|---|---|---|

| Total income | 175.5 | 175.4 | 100 |

| Expenses | -103.0 | -105.3 | 98 |

| Profit before loan impairments | 72.5 | 70.1 | 103 |

| Loan impairments | -1.4 | -3.1 | |

| Profit before tax | 71.1 | 67.0 | 106 |

| Loans (end of period) | 5,457m | 5,294m | 103 |

| Deposits (end of period) | 7,369m | 6,987m | 105 |

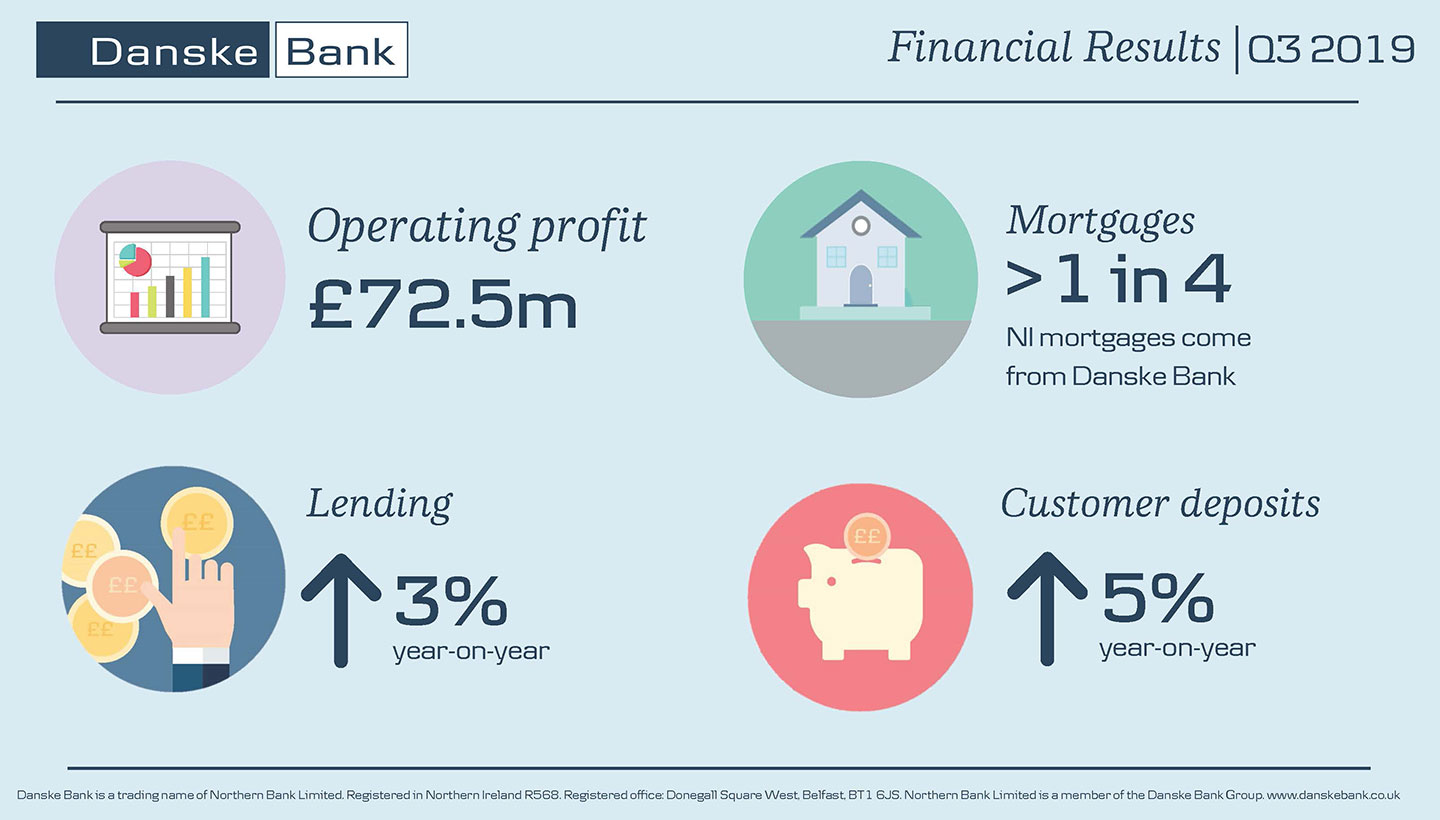

Danske Bank in Northern Ireland reports a profit before impairments of £72.5m for the 9 months to end September 2019.

Total income has been maintained at 2018 levels despite continued economic and political uncertainty. Lending is 3% higher year-on-year, with retail customer activity levels remaining satisfactory. New lending to businesses is impacted by Brexit, with some larger customers delaying investment decisions. Customer deposits grew by 5% year-on-year.

Costs have been reduced by 2% compared to the same period last year, with the Bank focused on managing its cost base while continuing to invest in improved solutions designed to ensure customer expectations are fully met.

Profit before tax is 6% higher, reflecting reduced loan impairments compared to the same period last year.

Danske Bank continues to have a strong capacity to support further lending growth as demonstrated by a loan to deposit ratio of 74% as at September 2019.

Commenting on the results, Danske Bank UK CEO Kevin Kingston, said:

“I am pleased to report an operating profit of £72.5 million for the first nine months of 2019. The underlying performance of the Bank remains satisfactory, with lending up 3% year-on-year.

“In Personal Banking, we continue to provide attractive mortgage packages with very competitive rates and market leading cashback offers. As part of our autumn mortgage campaign we announced further reductions in fixed rate mortgage products, which has led to an increase in approvals, especially in the re-mortgage switcher market. Our agile pricing approach ensures we remain attractive in what is an increasingly competitive segment. Danske Bank currently provides over one in four of all mortgages across Northern Ireland and our total mortgage lending is at its highest ever level.

“In Business Banking, demand for lending continues to be subdued as a result of uncertainty around the stretched Brexit process. It is important to note that our capacity to support new business lending remains strong, but current demand levels are below what we would expect in a more normalised trading environment.

“There has been a notable uplift in customer requests for support, advice and guidance from our Business Banking relationship managers – these are conversations we encourage and value.

“In the short-term, the business community awaits much-needed clarity on what the Brexit journey will look like. However the reality is, whatever shape it takes, it will only be the beginning of a new operating environment, and the process of change will be a significant factor in everybody’s lives for many years to come.

“As the biggest bank in Northern Ireland, Danske Bank remains resolute in our commitment to support customers, the economy and wider society.”

For more information about Danske Bank Group’s financial statements, please go to www.danskebank.com/reports