| (GBP millions) | Full Yr 2024 |

Full Yr 2023 |

Index 24/23 |

|---|---|---|---|

| Total income | 387.3 | 332.3 | 115 |

| Expenses | -178.7 | -159.4 | 112 |

| Profit before loan impairment charges | 208.6 | 172.9 | 121 |

| Loan impairments | 9.6 | 13.1 | |

| Profit before tax | 218.2 | 186.0 | 117 |

| Loans (end of period) | 6,327 | 6,066 | 104 |

| Deposits (end of period) | 11,434 | 10,724 | 107 |

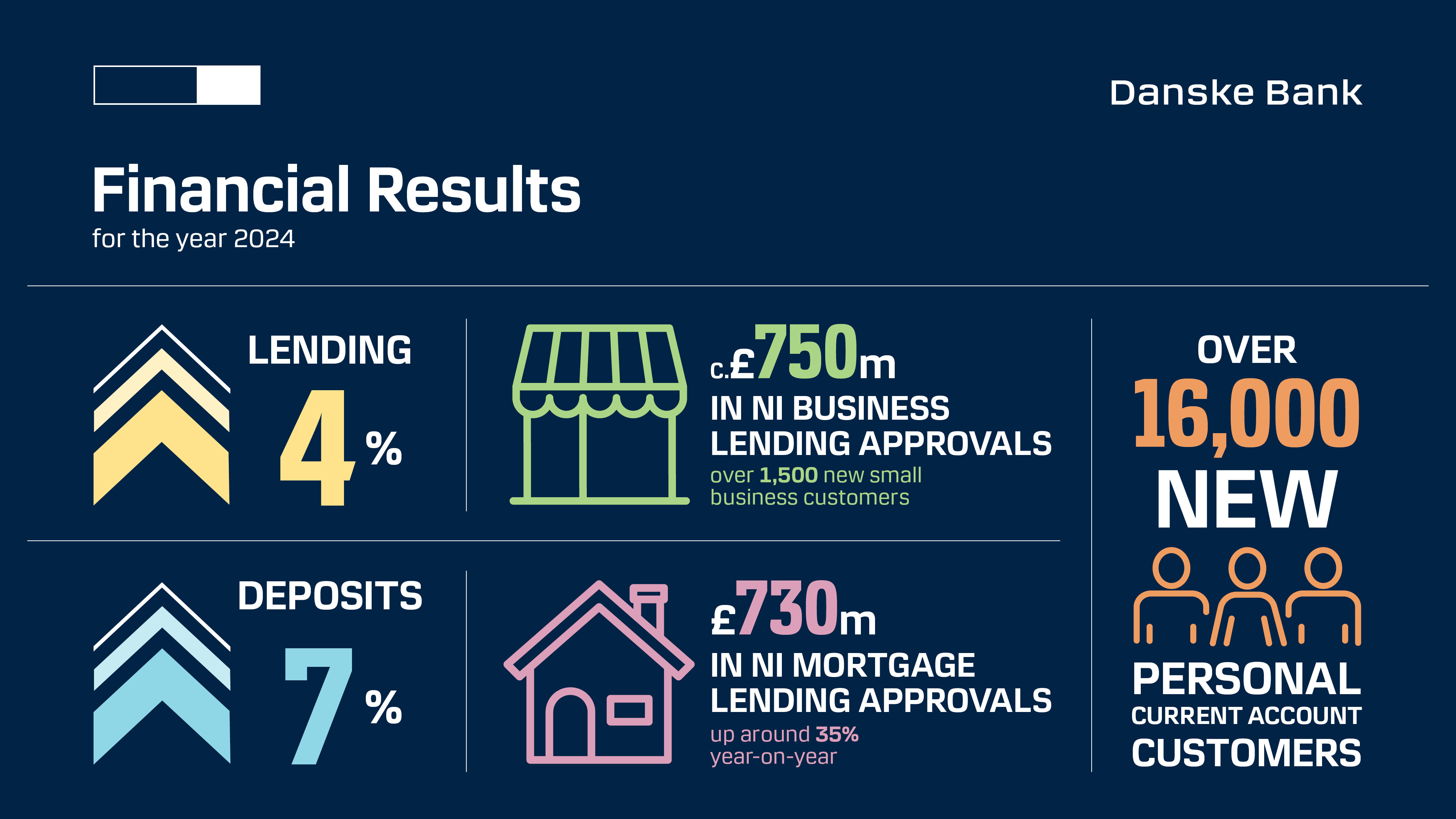

- Lending up 4% year-on-year.

- Deposits up 7% year-on-year. Both business and personal deposits are at a record high and this capacity represents an opportunity for local economic growth.

- A strong income performance was driven by lending and deposit growth in a higher interest rate environment.

- Costs were increased due to inflationary pressures, higher regulatory expenses and continued investment to improve customer experience.

- A net impairment release reflects the strength of the bank’s loan portfolio.

Vicky Davies, CEO of Danske Bank UK, commented:

“I am pleased to announce a strong financial performance for 2024. Moving into 2025 in a robust financial position means we are a bank that remains well positioned to support customers when they need us.

“We continue to focus on helping local businesses with their growth ambitions, enabling local people to realise their homebuying aspirations and on playing a key role in supporting the wider Northern Ireland economy.

“We have an ambition to become the clear leading provider of mortgages in Northern Ireland, and in 2024 we made great progress towards achieving this goal by delivering a record £730 million in local mortgage lending approvals - an increase of around 35% year-on-year.

“In 2023 over half of our local mortgage customers opted for a 5-year fixed mortgage product, whereas in 2024 63% chose a 2-year fixed option, with many anticipating that the Bank of England base rate was going to start to fall in the nearer term.

“We expect local mortgage lending to remain healthy this year, buoyed by the decreasing rate environment, low unemployment levels and strong buyer demand.

“We are also continuing to grow our mortgage business across the rest of the UK, where, in 2024, we provided over £290 million of mortgage lending approvals – up over 25% year-on-year.

“Last year we supported the local business community with around £750 million in business lending approvals. Notable business deals during 2024 included growth funding support for local enterprises Andras House, Finnebrogue, Used Cars NI, Exorna kitchens, the Deluxe Group, Connswater homes, Lunn’s Jewellers, Moore Concrete Products, McComb’s Coach Travel, Bathshack and Millar McCall Wylie Solicitors.

“We also welcomed over 1,500 new small business customers to Danske Bank and lending approvals for small businesses were up 14% year-on-year. Small businesses can apply to become a customer digitally through our website.

“When it comes to everyday banking, I am pleased to share that we opened over 16,000 new personal current accounts in 2024, an increase of around 60% year-on-year. You can apply for a Danske personal current account online in less than ten minutes.

“In addition to our easy-to-use digital banking platforms, Danske Bank customers are supported by a strong presence on the ground through our 24 branches, 5 banking hubs, our award-winning local contact centre and our local mortgage teams.

“On the business banking side, we have around 80 skilled and experienced relationship managers, who are supported by specialist teams in areas such as foreign exchange markets, asset finance, invoice finance, trade finance, cash management and sustainability planning.

“As a leading local bank, we also take seriously our role in helping to provide financial education across society. In 2024 colleagues at the bank volunteered to deliver our Money Smart programme in schools, helping improve the financial knowledge of over 11,000 young people throughout Northern Ireland.

“In addition, we have an important role in financing the societal transition to a more sustainable future, alongside guiding and supporting the sustainability approach of our customers – which is how we believe we can make the greatest impact. 2024 saw an increasing number of local business customers taking part in the Climate Action programme that we co-developed with Business in the Community. Part-funded by Danske Bank, we expect over 250 of our business customers to have completed it by the end of 2025.

“We believe the way we do business, is as important as the business we do. This approach was recognised in 2024 when we achieved Business in the Community’s CORE standard at Platinum level, benchmarking us as the highest placed bank in Northern Ireland in terms of responsible business activity, and as one of only five companies across all sectors to be recognised in this way.

“We look forward to the year ahead with optimism and a with a continued determination to support our customers, wider society and the economy.”