| (GBP millions) | H1 2020 |

H1 2019 |

Index 20/19 |

|---|---|---|---|

| Total income | 102.7 | 117.2 | 88 |

| Expenses | -70.0 | -69.4 | 101 |

| Profit before loan impairments | 32.7 | 47.8 | 69 |

| Loan impairments | -29.8 | -1.9 | |

| Profit before tax | 2.9 | 45.9 | 6 |

| Loans (end of period) | 5,507m | 5,447m | 101 |

| Deposits (end of period) | 8,600m | 7,206m | 119 |

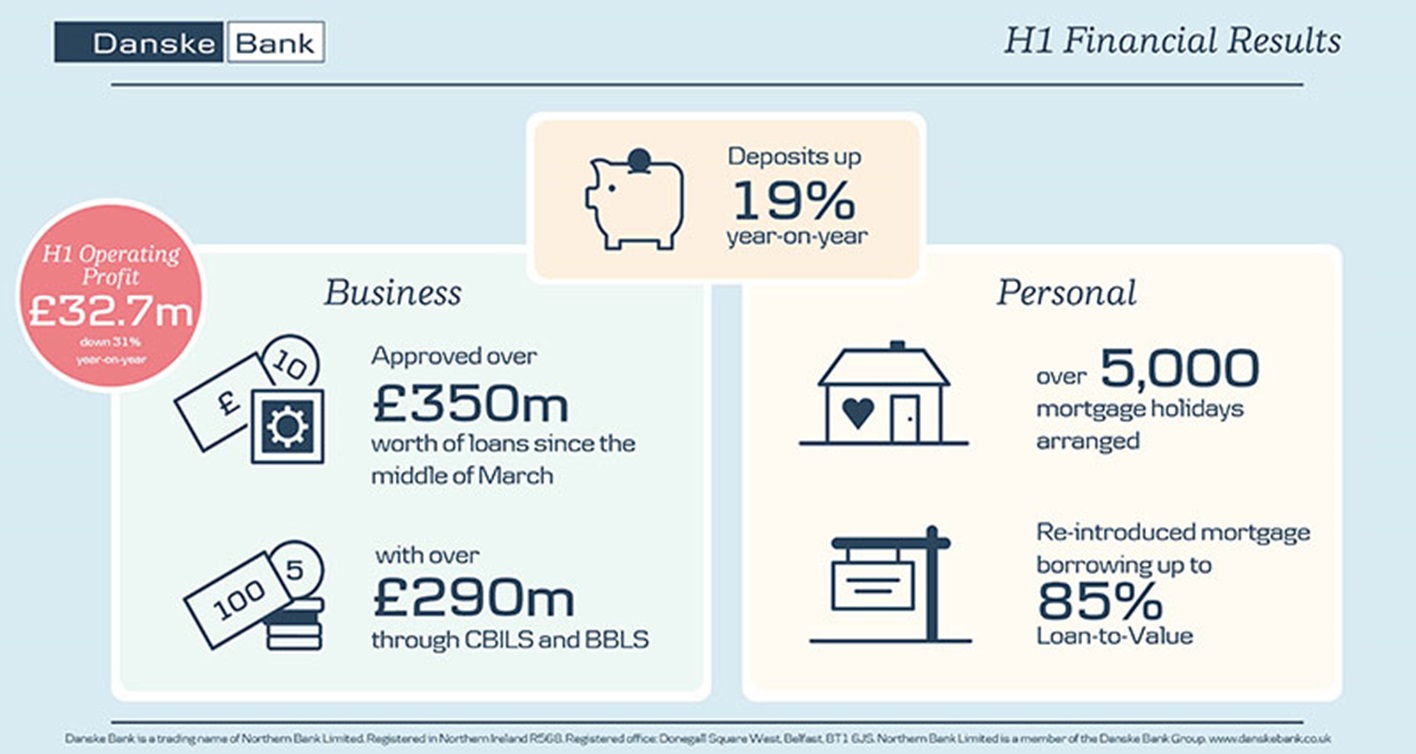

- Operating Profit of £32.7m for the first six months of the year. Income is down 12% as a result of sharply reduced interest rates and coronavirus disruption, whilst costs are flat.

- Lending balances reflect a combination of mortgage growth in Q1 and unprecedented business customer support in response to coronavirus disruption in Q2. Offsetting this, many personal and business customers have been focused on paying off debt and holding cash, with the latter very evident in the levels of deposit growth – up 19% year-on-year.

- Higher loan impairments allow for the potential that a greater number of customers will experience financial difficulties in the months ahead.

- Danske Bank maintains a strong funding, liquidity and capital position and will continue to use this capacity to support personal and business customers.

Kevin Kingston, CEO of Danske Bank UK, commented: “Income and profits are much reduced year-on-year as a result of coronavirus impacts, subsequent provision for potential future loan impairments and historically low interest rates. Our primary focus remains to support our customers through these troubling times and to support our colleagues, who, as key workers, have continued to offer the levels of service that the people of Northern Ireland have come to expect from Danske Bank. “In Corporate & Business Banking we have approved over £350 million worth of coronavirus related business support loans since the middle of March, with over £290 million of this volume provided through the Government backed Coronavirus Business Interruption Loan Scheme (CBILS) and Bounce Back Loan Scheme (BBLS). This assistance spans over 8,500 local business funding approvals and our volume of business lending during the crisis has been around treble the equivalent amount lent during the same period last year.

“In Personal Banking all of our branches have continued to remain open throughout the crisis to support our customers; offering greater branch availability, in terms of opening hours, than any other local bank. We arranged around 5,000 mortgage repayment holidays, with a further 675 personal loans and credit card repayment holidays.

“With the housing market now reopened we have re-introduced mortgage borrowing up to 85% Loan-To-Value, which we are actively promoting. We are also offering mortgage consultations remotely so that customers do not need to physically attend a branch for their mortgage meeting if they do not wish to do so. Early signs indicate that demand for mortgages is still there. It could be some time before we get an accurate picture of any impact on house prices. If prices contract a little, we believe it would be a relatively short-term correction.

“Customers, both personal and business, are saving more than ever, leading to a year-on-year rise in deposits of 19%. The uplift in deposits in Q2, coinciding with the lockdown period, was particularly significant, totalling almost £1 billion. If we are to get the Northern Ireland economy moving again, a lot will depend on how much of this pent up economic capacity turns into consumer spending and business investment.

“I would like to commend the Northern Ireland Executive for its work in recent months to support the private sector, noting there is much more hard work to be done. Uncertainty around Brexit outcomes for Northern Ireland still prevail, and the business community and political representatives must continue to work closely together if we are to safeguard our fragile economy.”

ENDS

For more information about Danske Bank Group’s financial statements, please go to www.danskebank.com/reports