- Customer lending up 3%

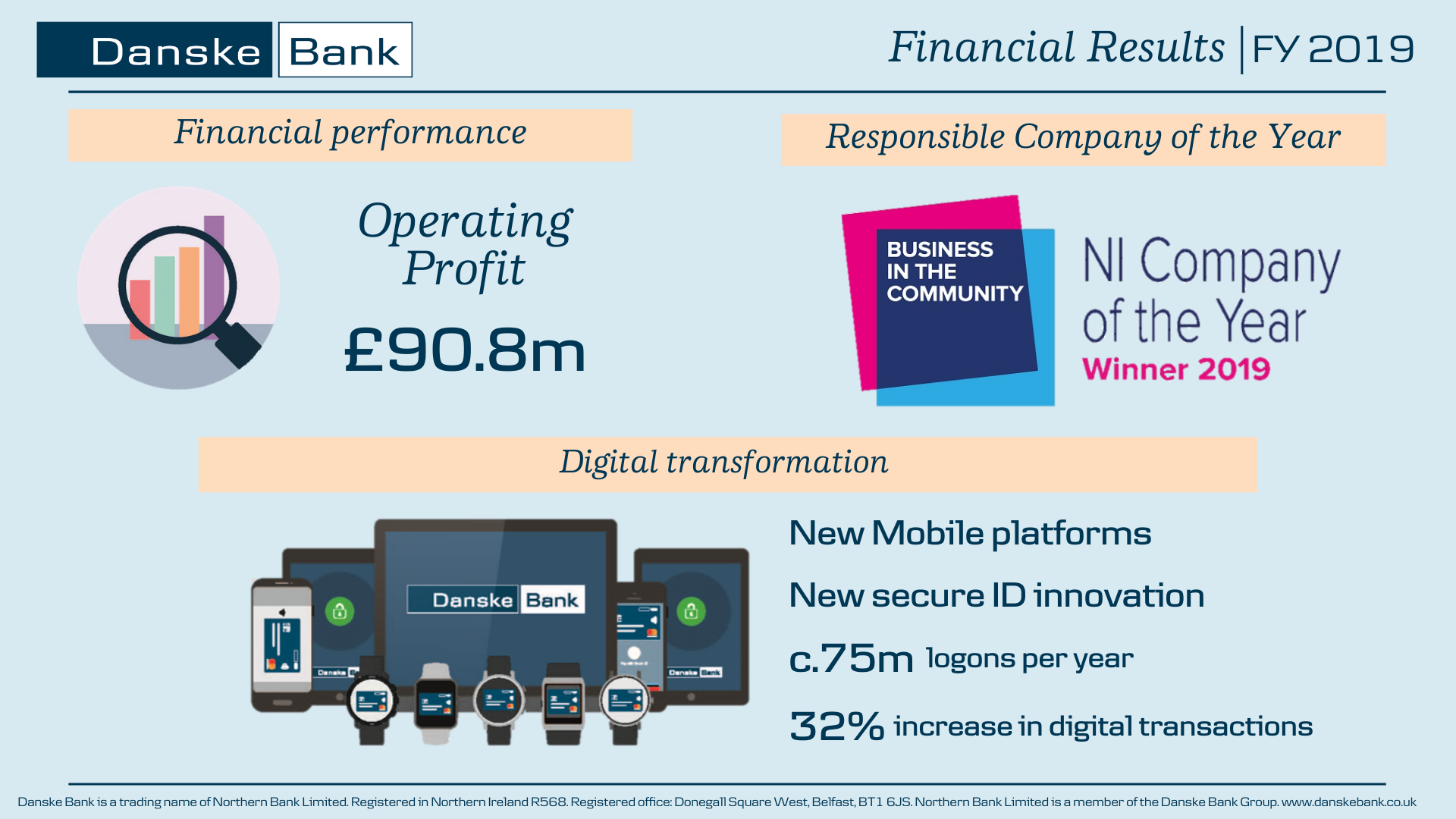

- Profitability maintained - £90.8 million

- Deposits up 7%

- Costs down 1%

| FINANCIAL RESULT (GBP millions) | 2019 | 2018 | Index 19/18 |

|---|---|---|---|

| Total income | 233.2 | 235.1 | 99 |

| Expenses | -142.4 | -143.5 | 99 |

| Profit before loan impairments | 90.8 | 91.7 | 99 |

| Loan impairments | -0.8 | -2.9 | |

| Profit before tax | 90.0 | 88.8 | 101 |

| Loans (end of period) | 5,541m | 5,383m | 103 |

| Deposits (end of period) | 7,585m | 7,109m | 107 |

Danske Bank in Northern Ireland reports an operating profit of £90.8 million for the 12 months to end December 2019.

Total income has been broadly maintained at 2018 levels, despite continued economic and political uncertainty. Lending is 3% higher year-on-year, with retail customer activity levels remaining satisfactory. New lending to businesses was impacted by Brexit, with some customers delaying investment decisions. Customer deposits grew by 7% year-on-year.

Costs are down by 1% compared to the same period last year, with the Bank focused on managing its cost base while continuing to invest in improved solutions designed to ensure customer expectations are fully met.

Profit before tax was 1% higher at £90 million, reflecting reduced loan impairments compared to 2018.

Danske Bank continues to have a strong capacity to support further lending growth as demonstrated by a loan to deposit ratio of 73% as at December 2019.

Commenting on the results, Danske Bank UK CEO Kevin Kingston, said:

“I am pleased to report an operating profit of £90.8 million for 2019. By maintaining our focus on customers, colleagues, partners and society, we increased lending volumes, delivered material customer experience improvements and were named Northern Ireland’s overall Responsible Company of the Year by Business in the Community.

Personal Banking & Small Business

“Mortgages were the key driver of the Bank’s overall lending in 2019. Danske Bank’s total mortgage lending is at its highest ever level, and it is noteworthy that in the past 12 months we have helped over 2,000 local first time buyers realise their home owning ambitions.

“The high quality service provided through our contact centre was recognised when we were named NI’s Contact Centre of the Year for the second year in a row.

“We also marked the first anniversary of the Catalyst Belfast Fintech Hub, a co-working space for early-stage tech entrepreneurs on the ground floor of our head office, run in partnership with the not-for-profit entrepreneurial eco-system, Catalyst. It is home to 33 tech start-up companies and since it opened we have welcomed over 7,000 visitors through its doors.

Corporate & Business Banking

“Demand for corporate and business lending overall was subdued as a result of uncertainty around the prolonged Brexit process. It is important to note that our capacity to support new business lending has remained strong, but current demand levels are below what we would expect in a more normalised trading environment.

“We continue to focus on strong relationship management, sectoral expertise and investment in added value for our customers.

Digital Transformation

“We continued to invest in improving our digital proposition and saw further adoption of our digital channels, with around 75 million digital logons by customers over the year. There was a 32% increase in digital transactions year-on-year, with a marked uplift in the popularity of wearable payments.

“A key milestone in 2019 was the successful migration of our personal customers to our new mobile banking app. Alongside this we launched a new security app, Danske ID, which replaced our former physical authorisation card and in doing so removed a key pain point for customers.

“We also launched a new Business eBanking platform called District, providing business customers with a customisable dashboard to aid them in managing their finances.

Societal Impact

“We play a significant role in driving Northern Ireland’s economic growth - ensuring we deliver our services responsibly, is key to who we are.

“It was a year of many highlights, but the one I am most proud of was being named Responsible Company of the Year by Business in the Community. It is a reflection of the positive societal impact we continue to make, alongside our various community partners, right across Northern Ireland.

“2019 also saw our successful three-year charity partnership with Action Mental Health come to a close. During this time we raised £208,000 to support mental health and resilience sessions for thousands of primary school children across Northern Ireland.

Economic & Political Environment

“As the UK navigates its way through the Brexit process, our role in Northern Ireland, as the biggest bank here, will be a crucial one. There will be continuing challenges to economic growth in 2020, and Northern Ireland in particular will need to adapt to new Brexit realities quickly.

“A rejuvenated and focused Northern Ireland Executive and Assembly is of paramount importance. I would like to congratulate the political parties for working together to return the institutions, we wish them well and they will have our full support.

“At Danske Bank we remain resolute in our commitment to support customers, the local economy and wider society.”

For more information about Danske Bank Group’s financial statements, please go to www.danskebank.com/reports