Commenting on today’s figures Patrick Mullan, Head of Mortgages at Danske Bank, said:

“The latest mortgage lending figures from UK Finance show that the housing market in Northern Ireland continues to grow, driven by first-time buyer and remortgage activity.

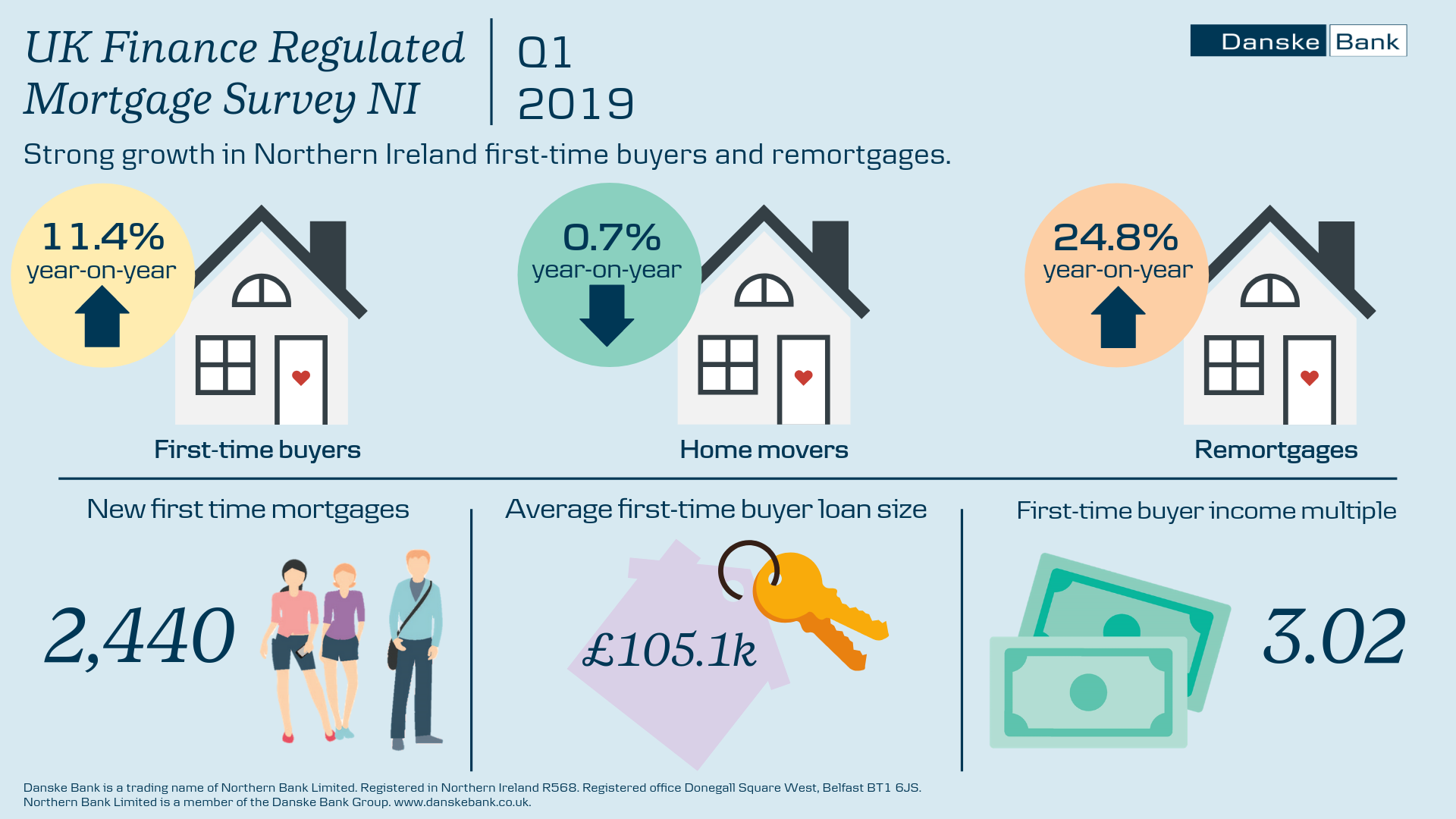

“The number of first-time buyer mortgages grew by 11.4% compared to the same period last year, a reflection of both affordability and the availability of new housing. First time buyers in Northern Ireland typically borrowed 3.02 times their income in quarter one, less than Scotland, Wales or London.

“Interestingly, the number of households remortgaging reached their highest levels in a decade, with a 25% uplift in the number of remortgages. We believe this has been driven by greater competitiveness between lenders providing customers with more choice, awareness of available mortgage options, and people moving off fixed rate deals and generally choosing to re-fix their mortgage for another period of time.

“There was a slight decrease in the number of mortgages completed by home movers, down 0.7% on the previous year’s quarter. As the quarter one figures are based on sanctions in late 2018, this may be attributed to seasonal factors, however as home movers tend to be more susceptible to confidence in the wider economy, it could also be a consequence of Brexit uncertainty. It will interesting to see if this trends continues in 2019.

“Overall we anticipate continued healthy growth in the mortgage market, driven by Northern Ireland’s position as the most affordable region in the UK for housing and a welcome increase in the supply of new housing."