| (GBP millions) | Full year 2021 |

Full year 2020 |

Index 21/20 |

|---|---|---|---|

| Total income | 198.2 | 203.2 | 98 |

| Expenses | -151.6 | -144.7 | 105 |

| Profit before loan impairments | 46.6 | 58.5 | 80 |

| Loan impairments | 14.7 | -45.4 | |

| Profit before tax | 61.3 | 13.1 | |

| Loans (end of period) | 5,479m | 5,622m | 97 |

| Deposits (end of period) | 10,589m | 9,626m | 110 |

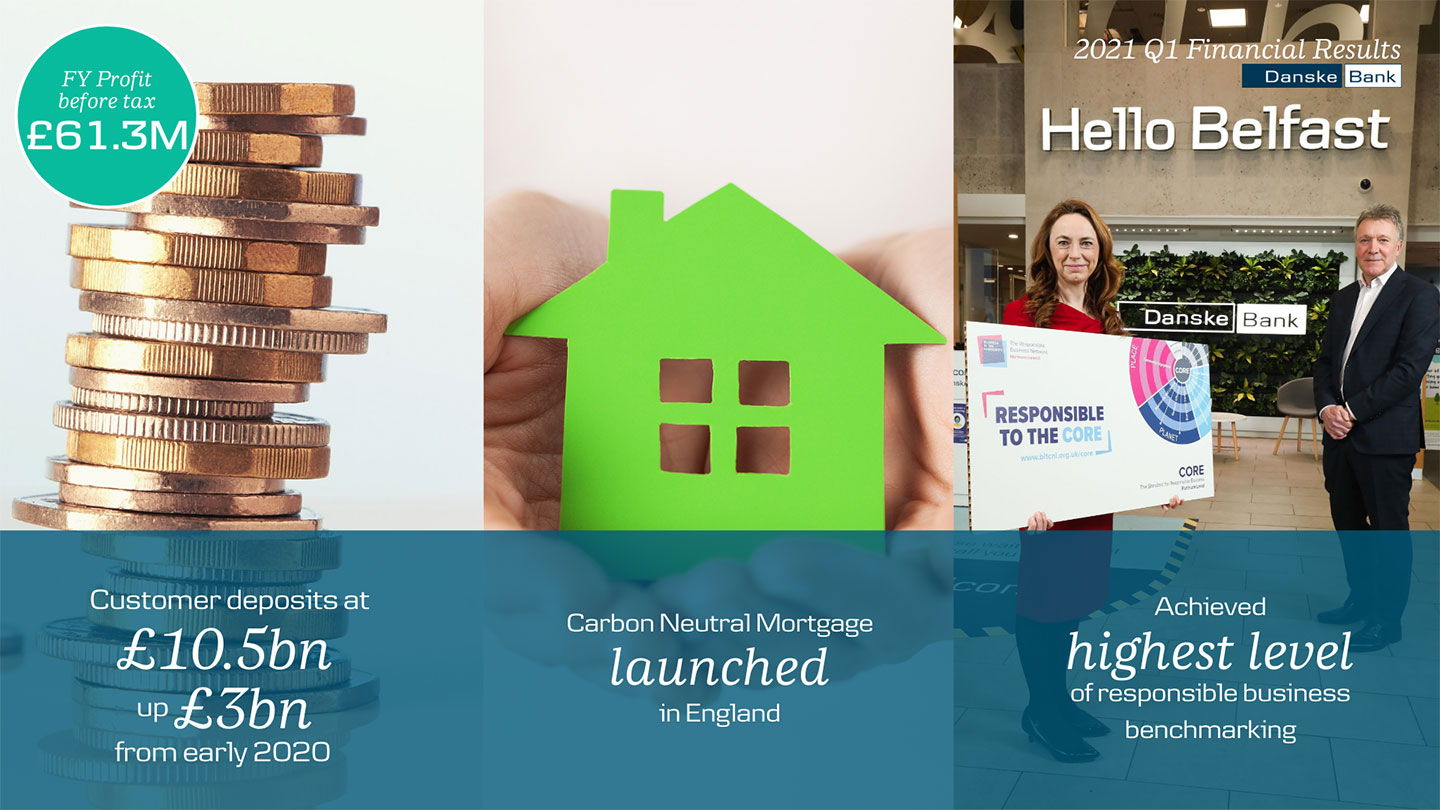

- Profit before tax up year-on-year at £61.3 million, with an improving economic environment seeing loan impairment provisions reduced.

- Customer deposits rose to record levels in 2021, to over £10.5 billion at end of year – a £3 billion uplift on the deposit levels recorded at the beginning of 2020.

Vicky Davies, CEO of Danske Bank UK, commented:

“I am pleased to share a set of results which reflect an improving economic outlook. 2021 was a challenging year characterised by the impacts of the pandemic and uncertainty arising from the end of the Brexit transition period. At Danske Bank we continued to support our customers, with a focus on helping Northern Ireland grow again.

Returning to Growth in NI

“The housing market remained buoyant in 2021 and we supported homebuyers and mortgage switchers by providing competitive products and simplifying our processes. We became one of the first banks in the UK to reintroduce 95% loan-to-value mortgages, and followed this by launching the UK’s first mortgage to be certified as carbon neutral by the Carbon Trust. We increased our maximum mortgage term from 30 to 35 years to help more customers, particularly first time buyers, as they seek to secure their first home.

“Small business lending, excluding government backed support loans in 2020, was up 9% year-on-year and is approaching pre-pandemic levels. Lending to larger businesses remains more subdued, due to many organisations carrying excess liquidity and some delaying growth plans.

Great Britain

“While Northern Ireland will always be our primary focus, 2021 saw us begin to pursue small pockets of opportunity for growth in Great Britain.

“On the corporate banking side, we are now a lender to the social housing sector in England, as well as being active in the syndicated lending space. In 2021, we supported these sectors nationally through the provision of around £300m in lending.

“On the personal banking side, we launched our Danske Carbon neutral mortgage through select brokers in the south of England. Mortgage provision through brokers in Great Britain will be an area of targeted growth for us in 2022 and beyond.

Sustainable and Responsible

“We’re committed to being a sustainable and responsible business. We were delighted that our carbon neutral mortgage was showcased at the global COP26 conference in Glasgow in November 2021.

“In Corporate & Business Banking we have provided ESG training for our relationship managers, have started work to help businesses become more carbon literate through the Climate Action Programme we co-developed with Business in the Community, and we have launched green loans for corporate customers.

“We also built on our strong reputation as a responsible business by achieving Business in the Community’s CORE accreditation at Platinum level -the highest level of responsible business benchmarking attainable. During the year we were also awarded Business in the Community’s Environmental Leadership award for our progress specifically around the sustainability agenda.

Looking ahead

“With regards to economic growth, at Danske Bank we think the annual rate of expansion for the year ahead is likely to remain relatively strong. However, there are a number of challenges that could affect the economy, including the impact of coronavirus variants, political instability, high inflation, supply chain disruption and labour shortages.

“We have seen a massive swell in deposits within our customer base, which are now at record levels – up £3 billion from those recorded in early 2020. When it comes to the pace of economic recovery, a lot will depend on pent up economic capacity like this turning into consumer spending and business investment. That will require increased levels of both consumer and business confidence.

“We are in the midst of changes to the local competitive landscape and an adaptation of the economy to what will be a new post-pandemic and post-Brexit business environment. Despite the challenges, with change comes opportunity, and we believe this transition will create opportunities for Danske Bank both in Northern Ireland and in Great Britain.

“Looking ahead we will remain focused on supporting our customers and making banking easier for them, while also developing new opportunities for business growth.”