Award-winning contact centre, ready to help and right here in your community

Extensive network of branches for when you want to come and see us

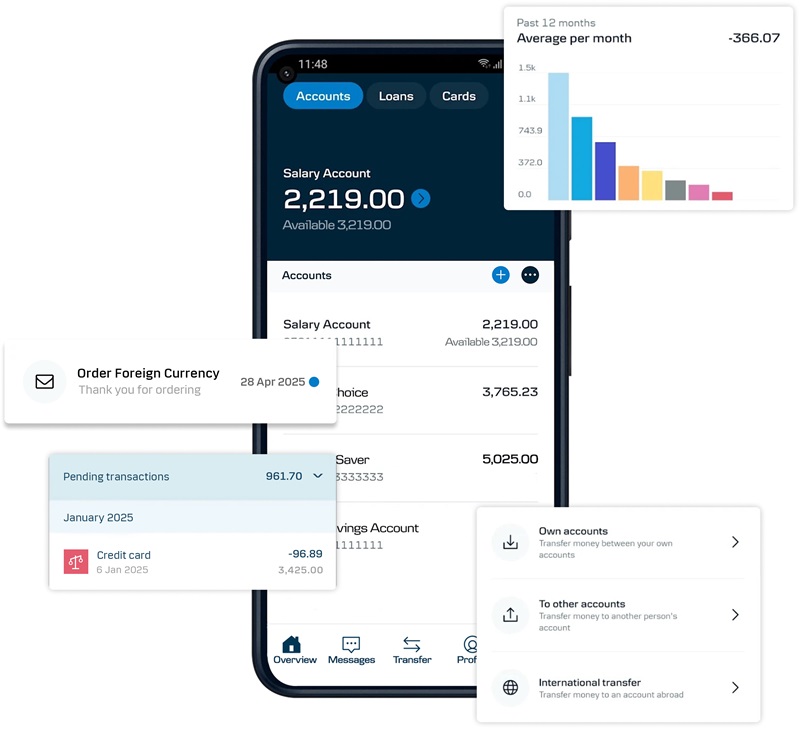

Convenient, seamless digital banking, trusted by over 250,000 users

5 Star rated current accounts

Award-winning contact centre, ready to help and right here in your community

Extensive network of branches for when you want to come and see us

Convenient, seamless digital banking, trusted by over 250,000 users

5 Star rated current accounts

Personal banking that offers more

Bank your way

Manage your account online, over the phone or via video call, or come and see us in-branch.

24/7 digital banking with eBanking and our mobile app – view spending, manage payments, chat to an adviser and more.

In the heart of your community, in person, at your local Branch, Post Office or Banking Hub.

By phone or video call, with our award winning contact centre.

Explore all ways to bank

Here to help

Reporting and fighting fraud

Find out how to identify and protect yourself from different types of frauds and scams, and how to report them.

Fraud and scams

Money worries

If you're concerned about the rising cost of living, or need help making repayments, we can help.

Visit money worries hub

Help going abroad

Card, cash or both? See how to use your Danske account if you’re travelling outside the UK.

Going abroad

Payments

Need help setting up one-off payments, Direct Debits or standing orders? Make it easy with eBanking.

Payments

Upload documents

If you’ve been asked to submit documents for proof of identity or address, or in advance of a meeting with us, you can...

Upload your documents

Savings calculator

Our clever calculator can help you work out how to reach your savings goals.

Use savings calculatorSupporting you through major life changes

Find more valuable support to help you manage your money throughout life's journey.

Visit support hubCustomer support

Looking for something specific? Here are our most popular shortcuts.

Chat to us

Here to talk

-

Mon–Fri: 8am–6pm / Sat: 9am–1pm / Sun: Closed

Chat with us

Here to take your questions

Start chatFind your nearest branch

Here to meet in person

Find branch details-

Existing Personal customer?

If you're an existing personal customer, you can contact us by phone or if you are registered for eBanking you can use our secure messaging service.

Send us a secure message via Secure Mail

Send message

eBanking and Mobile Banking Customer Support

NI/UK: 0345 603 1534

Outside NI/UK: +44 28 9004 9219

-

Mon–Fri: 8am–6pm / Sat & Sun: 9am–5pm

-

Independent service quality survey results

Personal Current Accounts

Published February 2026

As part of a regulatory requirement, an independent survey was conducted to ask customers of the 12 largest personal current account providers if they would recommend their provider to friends and family.

The results represent the view of customers who took part in the survey.

View all resultsPersonal Current Account Information

The Financial Conduct Authority requires us to publish the following information about our personal current accounts.

View information2024 Authorised Push Payment (APP) Scam Performance

Authorised push payment (APP) scams happen when someone is tricked into transferring money to a fraudster’s bank account. Information Danske Bank’s performance prior to the introduction of the reimbursement requirement in October 2024 can be found in PSR’s latest APP Scams Performance Report published in February 2026.

Latest stories

Danske Bank UK Financial Results Full Year 2025

Read our financial results for the full year 2025…

View results

Orto Pizza invests £1.2million in two new locations, supported by Danske Bank

Orto Pizza, a locally owned pizzeria chain, has invested £1.2million in a new restaurant and purpose-built production facility including an open to the public bakery, supported by Danske Bank.

Read more

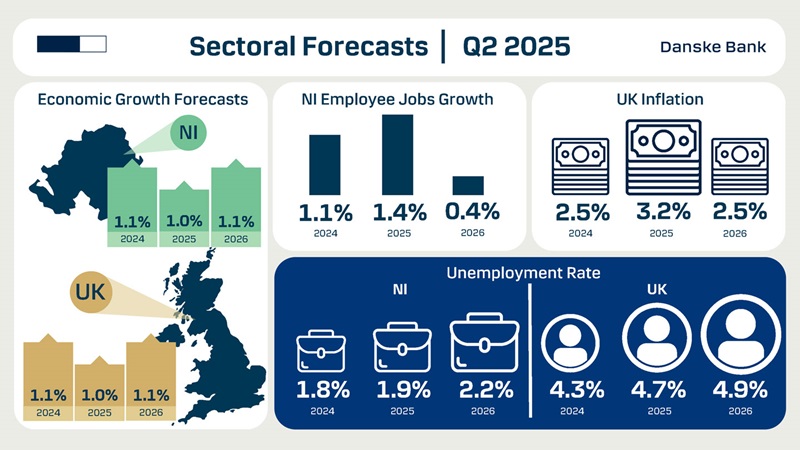

Danske Bank forecasts economic growth of 1.0% for Northern Ireland in 2025

Danske Bank has slightly revised up its forecast for economic growth in Northern Ireland in 2025 but says the rate of economic expansion is likely to remain modest next year.

Read forecast