Warning

We are aware that fraudsters are contacting customers pretending to be the bank.

Remember we will never ask you for your eBanking or District user credentials, to install any software on your computers, request remote access to view your screens, or direct you to a ‘live chat’ function.

Fraud and Scams Support

Welcome to our Fraud and Scams support hub where you can find support and guidance on different types of scams, how to protect yourself, industry advice and what to do if you feel your accounts or details have been compromised.

What is fraud?

Fraud is when someone steals your information or gains access to your device and uses this to complete transactions on your account without your knowledge. Fraudsters are skilled at taking over your devices and making payments using your online banking, Mobile Banking app, cards or even cheques without your knowledge.

Remember, we would NEVER ask you:

- for your log in credentials, card numbers, PINs or codes which we send you by text message

- to install software/apps on your computer or mobile device

- for access to any of your devices remotely, for example using AnyDesk or TeamViewer

What is a scam?

A scam is when someone lies or acts dishonestly to steal your money or information, often through trickery or manipulation.

Did you know, last year, 62% of scams reported to us started on social media sites like Facebook, Snapchat, Instagram, X and Whatsapp?!

Scammers will contact our customers to ask them to complete transactions for goods or services they will never receive or to send money to an account that the scammer will have access to or control.

Scammers rely on putting customer under pressure to make payments quickly. Often not giving them time to check if the details are from a genuine source.

Read more on scams and tips on how to spot them.

Find out moreReporting Fraud

Have you noticed unauthorised card transactions, payments or cheques from your account?

Please contact us immediately on our 24 hour telephone service by calling:

Alternatively, you can complete the report fraud form. You can also block your card using the Mobile Banking app or eBanking.

Reporting a Scam

Have you been tricked into making a transfer from your account and now think it's a scam?

Please complete the Scam Claim form below with as much information as possible to help with your claim:

More information on APP Reimbursement Scheme rules.

Card Disputes

Have you paid for goods with your card and have not received them or are you unhappy with the product/service?

You should complete card dispute form below with as much information as possible to help your dispute.

Alternatively, you can call customer service line on 0345 600 2882.

Scam Alert

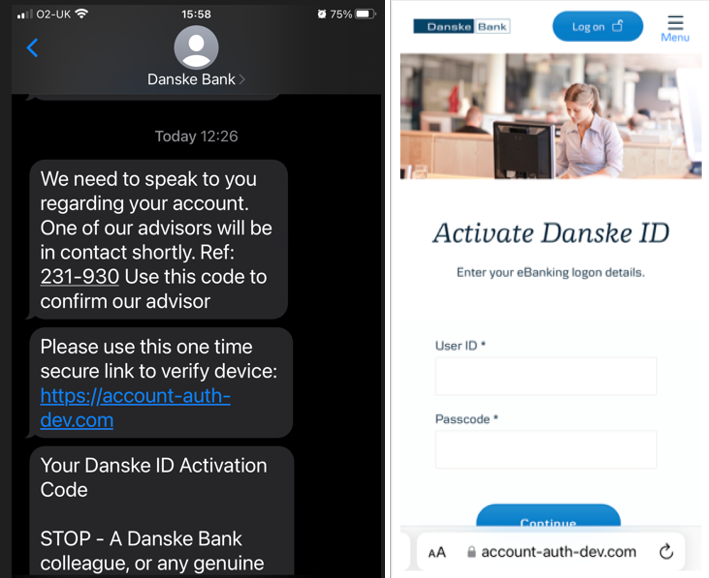

We are aware fraudsters are actively contacting some customers via text and phone pretending to be us. They may also create fake websites that are intended to replicate our site.

We have included examples of what these messages and fake websites could look like, to help you spot this scam.

As a reminder, we'll never contact you and ask any of the following:

- install software or give us access to view or control your PC or mobile

- share your eBanking user ID or password

- share codes you receive from us by text message

- share codes from your eSafe device or Danske ID

- move money to another account for 'security purposes'

- go to any website for help except danskebank.co.uk

If you have any concerns, please get in touch.

How we protect you

Integrated security in eBanking

Our systems use SSL encryption to ensure that:

- You can see that you are communicating with us

- We can identify you before transmitting any confidential information

- Unauthorised people can't access your information

Danske ID and eSafe ID

When you access eBanking on a web browser, we ask you for your user ID, passcode and approval from your Danske ID app or eSafe ID fob. Codes from this and those we send you are personal to you and should not be shared with anyone.

Confirmation of Payee

Confirmation of Payee (CoP) means that we will ask you for the name of the person or business you are paying as well as account number, sort code and account type when you are making a payment through eBanking and Mobile Banking. For more information on the responses you may see and our advice for each response go to our Confirmation of Payee page.

Payment Advice messages

When you are making a payment we will ask you what it’s for and based on your response provide you with some scam advice. You should read and consider this each time you make a payment – it could prevent you being the next scam victim.

How you can protect your devices

Keep your software updated

Always update programs when prompted. When you update your software – operating system, browser and all other programs – you close the security loopholes that hackers, malware and viruses find and exploit.

Antivirus

Install antivirus software, ensure that the program is updated regularly so your device has continual protection against any new viruses, and set it to automatically check any downloads to your device for viruses.

Install a firewall/security software

Installing a firewall will help prevent hackers from gaining access to your device. Make sure that it is kept fully updated to ensure your device is not left vulnerable to malicious attacks from a hacker.

Passwords

Make sure your device is secured with a password/passcode. Keep it secret. Don’t use names or birthdays as passwords - use a combination of letters, digits and symbols. Use different passwords for each site, and change them often.

Be careful what you download to your device

Don’t open attachments or click on links in unsolicited emails. Instead of opening programs directly, save them on your hard drive and have your antivirus program check them before you open them.

Social media

Be careful when opening hyperlinks, images or videos – even if they come from someone you know, they may contain malware. Do not disclose personal information, as you can’t be sure who will see it.

Only install apps you trust

Some apps may contain malware. Only download apps from legitimate app stores such as Google Play, App Store or Windows Market. Any apps downloaded from outside of these sources can potentially harm your device.

Keep your contact details updated

If your phone is lost or stolen you can change your mobile number and remove the old number in eBanking & Mobile Banking. It is important we have a correct phone number for you so you can receive text alerts and be kept up to date. You can also keep you email address up to date here too.

Ways you can stay safe

Some useful videos on more ways to keep safe.

Secure apps

Surf securely on Wi-Fi

Secure passwords

Social media

Scam examples

Common scam call

We’re aware of criminals calling some of our customers pretending to be the Bank! Please listen to this recording of a genuine call captured by one of our customers who was targeted in such a manner. Remember, we’ll NEVER call and ask you to share codes you receive from us by text message, your User ID or passcode, but a criminal would.

Caught in the Act

Listen to an "Amazon Scam" call received by one of our colleagues.

Read full information about this Amazon scam.

Other support

Additional support and guidance.

Action fraud

Action Fraud provide lots of guides and advice for the public to help inform and protect themselves against fraud.

The Little Guide to preventing fraud and cyber crime

Have a look at their Little Book of Big Scams

There are also video guides and even an audiobook. Listen to the audiobook The Little Book Of Big Scams from Metropolitan Police

Take Five to stop fraud

Take Five is a national campaign to help the public quickly recognise when something isn’t right.

![]()

Useful Links

Here are some other useful resources for guidance and support.

Consumer Council

Consumer Council for Northern Ireland

Citizens Advice

Get advice in Northern Ireland

Reporting to Trading Standards