Follow the steps below to set up your password or watch our video guide.

- Go to the Card Management Portal

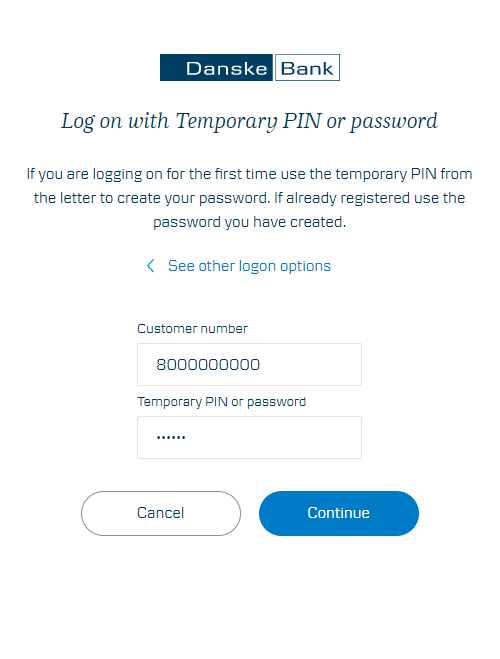

- Select ‘log on with Temporary PIN/Password’

- Enter your customer number

- Enter the temporary PIN (from the text message we sent to your mobile phone) and click 'continue'

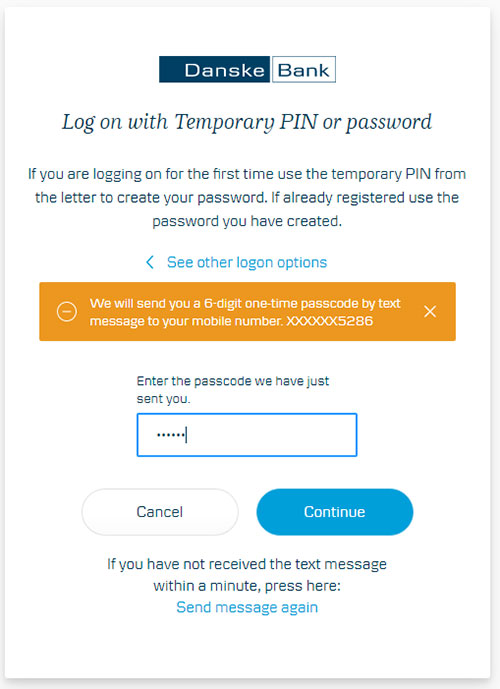

- Enter the one-time passcode sent to you by text message

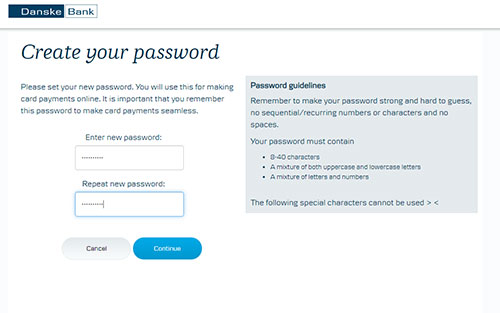

- Enter the password you want to use from now on to authorise online purchases and repeat to confirm your password

- Click 'Continue' and your password is created. This will be your personal password which you will use to approve online purchases along with the one-time passcode which we will text you.