To apply for a Small Business Current Account you'll need to:

- Be a Sole Trader, Partnership or Limited Company

- Have a turnover of up to £1 million

- Be aged 18 or over

Convenient day-to-day banking for businesses that want to use Danske Bank branches or local Post Offices.

You'll need to:

We will always consider your business banking needs when determining the right account for you. If your needs change at any time or you feel your account is no longer right for your business, you can get in touch to discuss your options.

(includes up to 5 accounts)

If you prefer to manage most of your finances through online banking, our Small Business Digital Account could be a better choice for you.

We currently have a 2 year fee free offer with our Small Business Digital Account. Find out more.

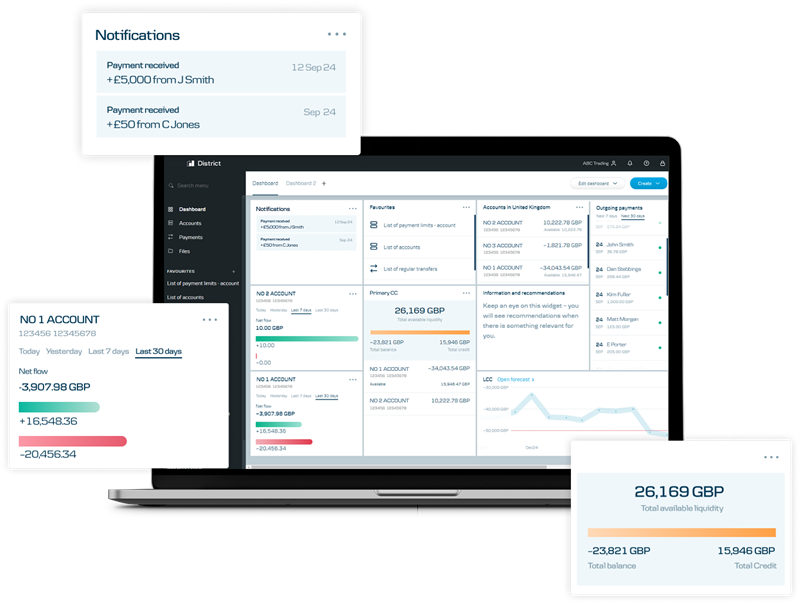

"Danske's online business banking platform, District is perfect for my growing business."

Carol Little, Alana Interiors, Craigavon

District is our online financial platform. Accessible online or on mobile via your browser, it provides a complete overview of your finances, no matter the complexity.

Our mobile and tablet business app allow you to create and authorise payments, view transaction history, send messages to your advisor and much more.

Explore District Explore Business AppsWhether applying online, over the phone or in branch, we've made it easy to open an account with us. The Current Account Switch Service makes switching to us stress free too.

Learn more and view eligibility criteria

If we are not able to complete the switch on your chosen date, we will contact you to agree a new one.

Direct access to local dedicated teams providing expert banking support for you and your business. Talk to one of our team to see how we can help.

“Being able to contact your local Business Adviser at Danske quickly has been fantastic - they understand our past, present & future plans.

Susie Hamilton Stubber, Burren Balsamics, Co. Armagh

When you've reviewed the Things you need to know information above, select your business type to start your application.

If there is anything you don't understand, or you require more information, please get in touch.

If you’re a Sole Trader or a Limited Company with up to 3 directors, you can continue your application here.

ContinueThe following FAQs are only relevant for Sole Traders and Limited Companies with up to 3 directors.

Published February 2026

As part of a regulatory requirement, an independent survey was conducted to ask customers of the 5 largest business current account providers if they would recommend their provider to other small and medium enterprises (SMEs). The results represent the view of customers who took part in the survey.

View all results

Mon–Fri: 8am–6pm / Sat: 9am–1pm / Sun: Closed

Mon–Fri: 8am–6pm / Sat: 9am–1pm / Sun: Closed

Here to take your questions

Start chatHere to meet in person

Find branch detailsIf you're an existing business customer, you can contact us by phone or if you are registered for District you can use our secure messaging service.

NI/UK: 028 9031 1377

Outside NI/UK: +4428 9031 1377

Mon–Fri: 8am–5pm / Weekends: Closed

Mon–Fri: 8am–5pm / Weekends: Closed

If you have surplus cash in your Business Current Account, we can help it work harder for you. Our Business Investment Account is an instant access, interest-earning account. If you’re happy to put surplus cash away for longer, we have a Business Fixed Term Deposit account that may offer you a higher rate of interest.

We have a wide range of borrowing options to help fund and grow your business. From Overdrafts to Fixed Rate Loans and Variable Rate Loans, Asset Finance to Sustainable Finance, we are on hand to discuss options that best suit the needs of your business. We can also support you with our available Government Loan Schemes.

Content is loading

Content is loading